Federal prosecutors announced Ippei Mizuhara transferred nearly $17 million out of Ohtani's bank account to cover $40 million in gambling losses.

Former reality TV star Brittish Williams' ex-boyfriend, Lorenzo Gordon is facing federal PPP fraud charges

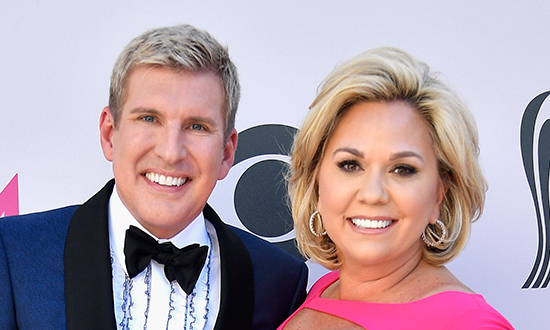

Todd and Julie Chrisley may soon call a federal penitentiary home after they were both found guilty of income tax evasion

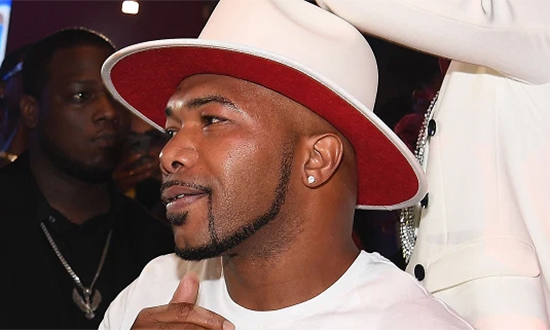

Former Love & Hip-Hop: Atlanta cast member Maurice "Mo" Fayne was sentenced to 17 years in prison for defrauding the federal Paycheck Protection Program

Accountant Jason Thornton reacted to controversial "Financial Strategist" Marcus Barney allegedly teaching people how to commit bank fraud

A Louisiana woman was arrested for refusing to return $1.2 million, mistakenly deposited into her brokerage account

A woman who believed she was communicating with pop singer Bruno Mars via text messages was scammed out $100,000

A member of the hip-hop group Pretty Ricky was arrested and charged with wire fraud, bank fraud, and conspiracy

Former Love & Hip-Hop: Atlanta cast member Maurice "Mo" Fayne, pictured with ex-girlfriend Karlie Redd, has been indicted

A reality TV personality who starred in VH1's Love & Hip-Hop: Atlanta has been arrested and charged with misusing over $2 million from the federal Paycheck Protection Program (PPP)