\Newsone.com dragged Jason Whitlock for "fetishizing" Caitlin Clark and insulting Black WNBA players, before targeting Simone Biles.

She took aim at writer/producer Jo-Issa Rae Diop, a.k.a. Issa Rae, for not empowering her on "insecure." She accused Issa of kicking her out of a party

In a viral video, the singer/songwriter, born Shaffer Smith, is berated and antagonized by influencer Sade Bagnerise. She livestreamed their argument

Donna fell seriously ill within an hour after eating the sushi roll. She was in extreme pain and unable to speak. Donna died 12 days later.

In a video posted on TikTok on Wednesday, Chew assured TikTok users that ByteDance, the app's Beijing-based parent company, will not sell the app.

Megan Thee Stallion's former cameraman, Emilio Garcia filed a lawsuit alleging she forced him to watch her have sex with another woman.

Rodney Jones filed a sexual harassment lawsuit against Sean Combs on February 26 in the Southern District of New York. In the complaint, Jones alleged that

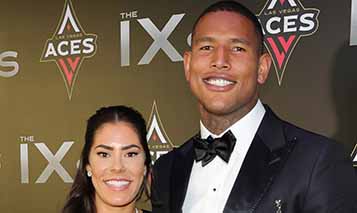

Kelsey trended all day Tuesday after she announced the news on Instagram. "I'm devastated. I walked through fire for that man, but now I see it's time to go."

The U.S. Senate is also expected to ban TikTok in next week's vote. President Biden has said he will sign the bill into law if it comes across his desk.

The FTC on Tuesday afternoon voted 3-to-2 to approve the new rule, which will go into effect in 120 days. Two Republicans voted against