Former Love & Hip-Hop: Atlanta cast member Maurice "Mo" Fayne was sentenced to 17 years in prison for defrauding the federal Paycheck Protection Program

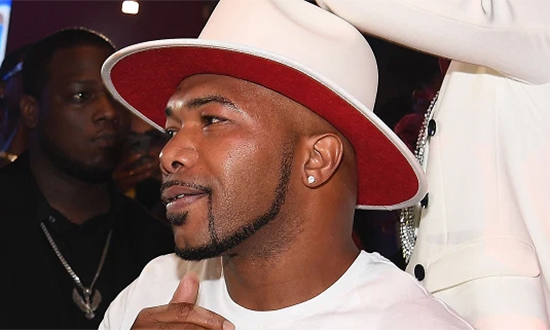

Former Love & Hip-Hop: Atlanta cast member Maurice "Mo" Fayne, pictured with ex-girlfriend Karlie Redd, has been indicted

A reality TV personality who starred in VH1's Love & Hip-Hop: Atlanta has been arrested and charged with misusing over $2 million from the federal Paycheck Protection Program (PPP)