Former reality TV star Brittish Williams' ex-boyfriend, Lorenzo Gordon is facing federal PPP fraud charges

A former Atlanta attorney was convicted Tuesday of misusing nearly $8 million in federal pandemic funds

A former Virginia state employee will spend nearly 6 years in prison for stealing $1.8 million

Actress Ion Overman is among 19 people indicted for federal Paycheck Protection Program (PPP) fraud in Atlanta

Christmas came early for a self-professed "entrepreneur" who fleeced the government's pandemic relief PPP program to enrich himself

Jason Lary, the Mayor of Stonecrest, Georgia, was arrested and arraigned on federal charges of wire fraud related to the theft of federal PPP relief funds

An Instagram model is pleading with Internet users to donate money to GoFundMe to help her repay a PPP loan

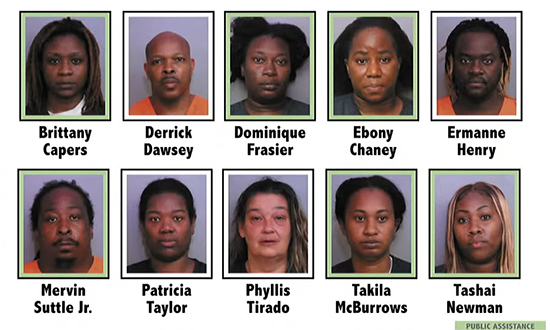

The Polk County Sheriff's Office announced the arrest of an 11th suspect who illegally received $2,000 in federal CARES Act Funds

The feds are cracking down on Georgia employees who submitted fake medical excuse letters