Rapper "T.I." owes over $2 million in back taxes to the IRS. According to court documents obtained by In Touch, T.I. was hit with a federal...

The number of people who owe taxes has surged since last year, and the year before that. IRS officials are concerned that fewer tax refunds means

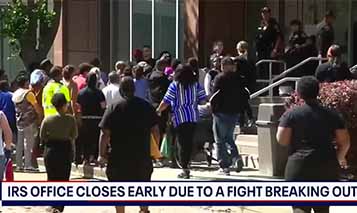

Taxpayers went to the Houston IRS office hoping to get help filing their taxes by today's deadline (April 15). Some people got in line at 3 a.m. to be the first

Beyonce Knowles-Carter is taking on the nation's most powerful debt collection agency -- the Internal Revenue Service

Shakira and her sons were seen leaving Miami amid reports she may face 8 years in prison for income tax evasion

Blac Chyna admitted in open court that she hasn't paid income taxes in three years. The IRS had open ears during her testimony

Kandi Burruss allegedly has a big cash flow problem like her former co-star NeNe Leakes

The IRS is sending out notices to unlawful taxpayers reminding them to report stolen goods as income on their tax returns

Chris Tucker owes the Internal Revenue Service $9.6 million in back taxes. According to court documents obtained by ET

The IRS will begin making direct deposits of the new extended child tax credit payments today, July 15