The number of people who owe taxes has surged since last year, and the year before that. IRS officials are concerned that fewer tax refunds means

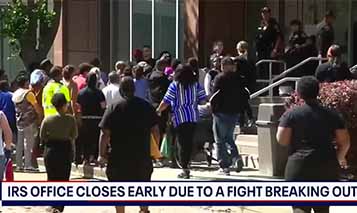

Taxpayers went to the Houston IRS office hoping to get help filing their taxes by today's deadline (April 15). Some people got in line at 3 a.m. to be the first

Beyonce Knowles-Carter is taking on the nation's most powerful debt collection agency -- the Internal Revenue Service

House Republicans voted Monday night to defund $72 billion that President Biden earmarked for 87,000 new IRS agents

Detroit rapper Sameerah "Creme" Marrel, who was on the run from the law for tax fraud, was arrested on Friday

Ye West's wealth continues to shrink by the hour. The IRS reportedly froze $50 million in his bank accounts for failure to pay back taxes

Reality TV stars Todd and Julie Chrisley are currently on trial for tax evasion and bank fraud

The IRS is sending out notices to unlawful taxpayers reminding them to report stolen goods as income on their tax returns

Chris Tucker owes the Internal Revenue Service $9.6 million in back taxes. According to court documents obtained by ET

The IRS will begin making direct deposits of the new extended child tax credit payments today, July 15